I am unable to cash it because it is over one year old. I found my uncashed refund check from a prior year. What should I do?įor a replacement check you must call the Comptroller's Office at 1-80. For more specific information about the status of your refund after the Illinois Department of Revenue has finished processing it, you can check the Illinois Comptroller's Find Your Illinois Tax Refund System.

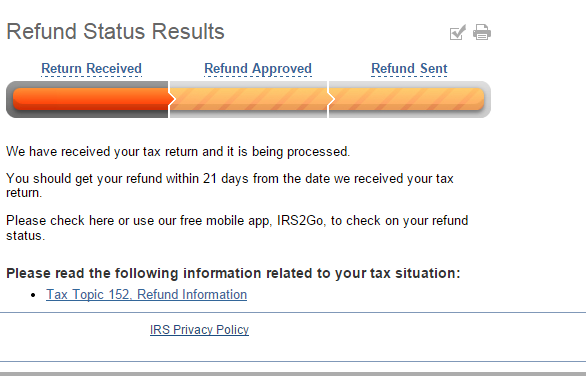

According to your site it has been more than 30 days since it was mailed. Use Where's My Refund to find out if the Illinois Department of Revenue has initiated the refund process. I have lost or misplaced my refund check, how do I go about getting a new one?įor a replacement check you must call the Comptroller's Office at 1-80. You may use our refund inquiry application to check the status of your current year refund. Waiting for a Tax Refund Deposit to post to your account this week Find Banks, Credit Unions, and Non-Traditional Cards that could post deposits early here. In general, you can expect your refund to take longer than previous years as we continue our efforts to prevent identity theft and fraud. If you file a paper return, the timeframe is extended. If you file your return electronically and have your refund directly deposited into your checking or savings account, you will receive your refund faster. If your refund amount is different than what is shown on your return, you will receive a notice within 7 to 10 business days explaining the difference. is delayed in opening the NC tax season to ensure accuracy in processing and taxpayer protection.

Please allow the appropriate time to pass before checking your refund. Thank you for using the Wheres My Refund Application.

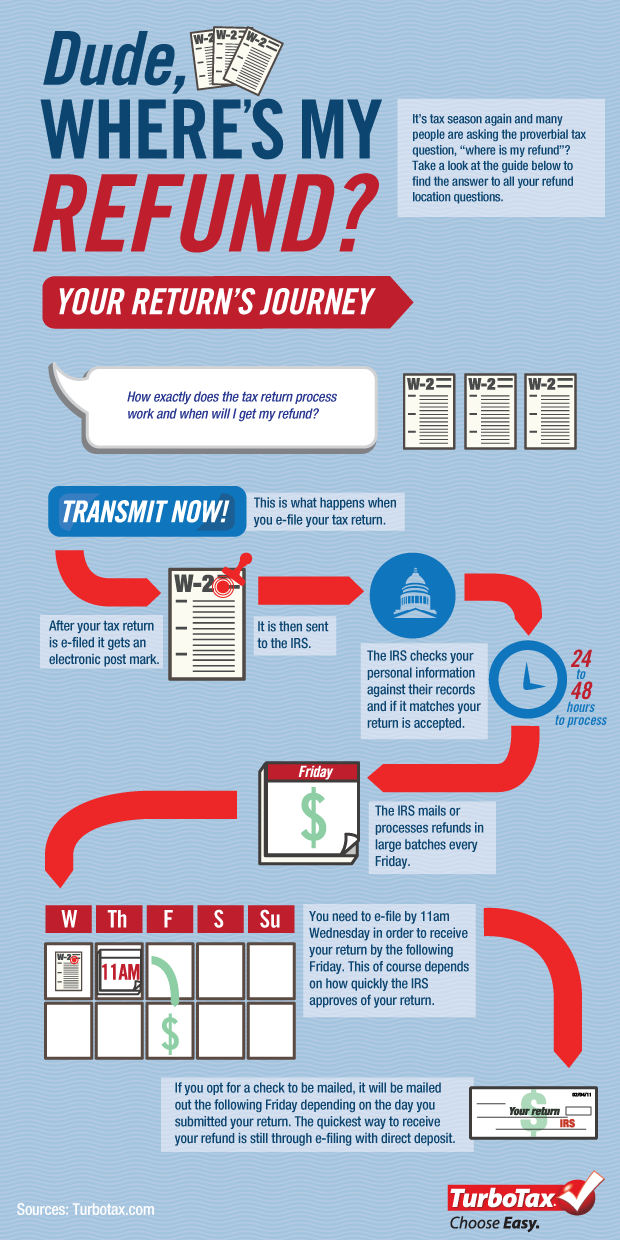

What do I do if my refund is different than what was shown on my return? Wheres My Refund You can check your refund status online. For more specific information about the status of your refund after the Illinois Department of Revenue has finished processing it, you can check the Illinois Comptroller's Where's My Refund? to find out if the Illinois Department of Revenue has initiated the refund process. After the IRS accepts your return, it typically takes about 21 days to get your refund.

0 kommentar(er)

0 kommentar(er)